Chase Sapphire Preferred Card: Main details and How to Apply

Anúncios

The Chase Sapphire Preferred Card is a mid-tier travel rewards credit card that blends affordability with premium-level perks.

It’s often recommended as the “first serious travel card” for those starting their journey into points and miles because it delivers a strong welcome bonus, flexible redemption options, and solid travel protections

Anúncios

Next, we’ll break down its benefits, fees, reputation, and the application process so you can decide if it’s the right fit.

What are the card’s advantages?

When applying for a card, it’s crucial to check out the benefits it offers. Check it out!

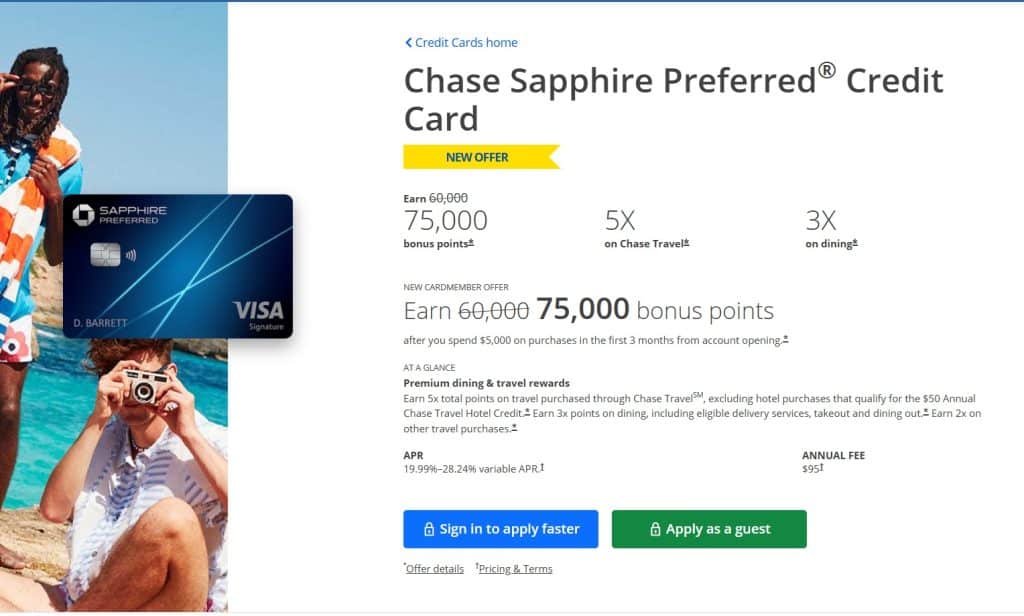

Earn 75,000 bonus points

One of the biggest draws of the Chase Sapphire Preferred Card is its generous welcome offer.

Anúncios

Currently, new cardmembers can earn 75,000 bonus points after spending $5,000 on purchases in the first 3 months from account opening.

Chase has specific restrictions that affect who can earn this bonus:

- You cannot earn the bonus if you currently have any personal Sapphire card open, including the Chase Sapphire Reserve®.

- You are not eligible if you have received a new cardmember bonus for any Sapphire card in the past 48 months.

- Chase may also review your recent account history — including the number of cards you’ve opened and closed — when determining eligibility.

$50 Annual Chase TravelSM Hotel Credit

Each account anniversary year, you’ll get a $50 statement credit for hotel bookings made through Chase Travel.

This benefit alone offsets more than half the annual fee for many cardholders.

More ways to earn

- 5× points on travel purchased through Chase Travel

- 3× points on dining, select streaming services, and online grocery purchases (excluding Walmart, Target, and wholesale clubs)

- 2× points on other travel purchases

- 1× point on all other purchases

Over $200 in partnership benefit value

Chase often partners with popular brands to deliver extra perks, such as complimentary DoorDash DashPass membership, Instacart+ trials, and Lyft ride credits.

The combined value of these benefits can easily exceed $200 per year if used regularly.

Chase Pay Over Time

For added flexibility, Chase offers an installment payment option on eligible purchases, allowing you to spread out costs over time.

While this comes with interest, it can be useful for managing large expenses without missing payment deadlines.

What are the card fees?

Before applying for the Chase Sapphire Preferred Card, it’s important to understand its costs so you can weigh them against the rewards and benefits it offers.

While the annual fee is relatively modest for a travel rewards card, there are other charges to keep in mind. Especially if you plan to carry a balance, use the card abroad, or take advantage of services like balance transfers or cash advances.

Here’s a breakdown of the key fees you should know:

- Annual fee: $95

- Foreign transaction fees: None (ideal for international travel)

- Balance transfer fee: $5 or 5% of the amount transferred, whichever is greater

- Cash advance fee: $10 or 5% of the amount advanced, whichever is greater

- APR: Variable, typically in the high-20% range, pay balances in full to avoid interest charges.

Is Chase trustworthy?

Yes, Chase is widely regarded as one of the most reliable and reputable banks in the United States.

As a division of JPMorgan Chase & Co., it is part of one of the largest financial institutions in the world, serving over 80 million consumers and millions of small businesses nationwide.

Chase consistently earns high marks for its customer service, fraud protection systems, and the overall quality of its credit card offerings.

The bank has robust digital tools, including a secure mobile app that allows you to monitor your account in real time, lock your card instantly if it’s lost or stolen, and receive fraud alerts immediately.

One of the strongest aspects of Chase’s reputation comes from its Ultimate Rewards® program.

In addition, Chase is known for maintaining clear and transparent terms on its credit cards, as well as offering a variety of protections such as zero liability for unauthorized purchases, purchase protection, and comprehensive travel insurance benefits.

Pros and Cons

Pros

- Generous welcome bonus with high travel redemption value

- Multiple bonus categories that reward both travel and everyday spending

- Strong travel protections (primary rental car insurance, trip cancellation/interruption coverage, baggage delay insurance)

- No foreign transaction fees

- Access to 1:1 transfer partners like United, Southwest, Hyatt, and Marriott

Cons

- Annual fee (though modest, it may deter very casual card users)

- No airport lounge access or luxury perks like the Chase Sapphire Reserve®

- Best value requires using Chase Travel or transfer partners, which may not appeal to cash-back-focused users

How to apply for the card?

Check out the step-by-step guide to requesting your card:

- Check Your Credit Score

- Review Chase’s Rule – You won’t be approved if you’ve opened more than 5 credit cards from any issuer in the past 24 months.

- Gather Your Information – Social Security number, income, employment details, and housing costs.

- Apply Online or In-Branch – The online application is quick and can return a decision within minutes.

- Wait for Approval – If not instantly approved, Chase may request more information or require a review, which can take a few days.

If you’ve read this far and think the Chase Sapphire Preferred® might be right for you, now’s the time to act. Apply through Chase’s official site to secure the current welcome bonus and start earning travel rewards today.

Contact Chase at 1-800-432-3117.

Review produced in August/2025. Please note: card details and information may change at any time. Therefore, check the official website before applying.