Bank of America Travel Rewards: Benefits and How to get Yours

Anúncios

If you’re searching for a travel credit card that blends simplicity, flexibility, and solid rewards, the Bank of America Travel Rewards Credit Card is worth a close look.

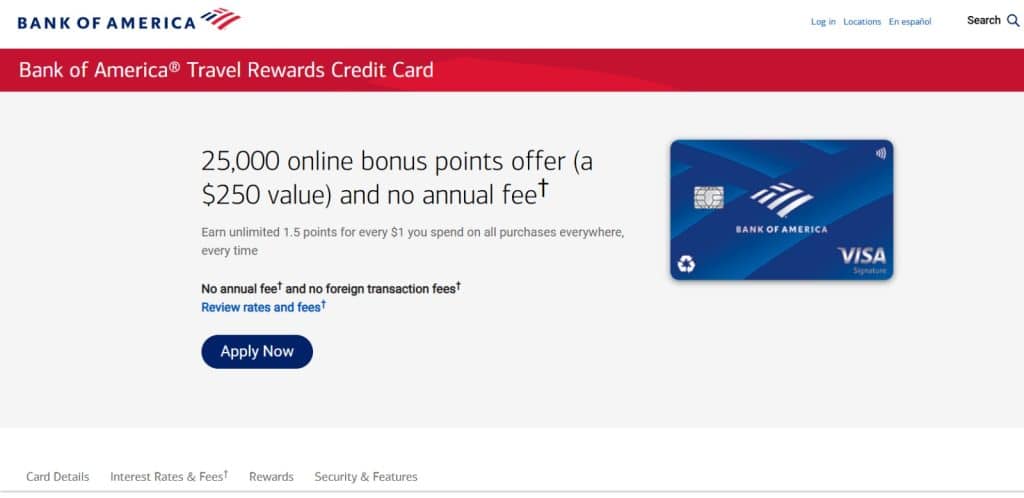

It stands out for its $0 annual fee, no foreign transaction fees, and an easy-to-understand points system that works for all kinds of purchases, not just travel bookings.

Anúncios

Whether you’re buying groceries, paying for gas, or reserving a flight, you’ll earn rewards that can be redeemed toward your next adventure.

What are the main card fees?

One of the strongest selling points of the Bank of America Travel Rewards card is its lack of common credit card fees. Here’s what you need to know:

- Annual Fee: $0, you’ll never pay to keep the card in your wallet.

- Foreign Transaction Fees: None, you can use it abroad without worrying about extra charges.

- APR: Introductory 0% APR for the first 15 billing cycles on purchases and balance transfers made within 60 days of account opening, then a variable APR currently ranging from 18.24% to 28.24%, depending on your creditworthiness.

- Balance Transfer Fee: 3% of each transaction (minimum $10) during the intro period.

By eliminating the annual fee and foreign transaction charges, the card immediately becomes a budget-friendly option for travelers and everyday spenders.

Anúncios

Discover the benefits it offers

The rewards program is where the Bank of America Travel Rewards Credit Card really shines. Let’s break down the key perks:

Unlimited points

You’ll earn 1.5 points for every $1 spent on all purchases, with no spending categories to track.

Points never expire, and you can redeem them at any time for statement credits toward travel and dining purchases.

If you book through the Bank of America Travel Center, you’ll earn even more, up to 3 points per $1.

Low Introductory APR Offer

For new cardholders, the 0% intro APR on purchases and balance transfers for 15 billing cycles is a great way to finance a trip or pay down a transferred balance without interest.

Just be sure to pay off the balance before the promotional period ends to avoid the variable APR kicking in.

25,000 online bonus points offers

When you spend at least $1,000 in purchases within the first 90 days of opening your account, you’ll earn 25,000 bonus points, enough for a $250 statement credit toward travel purchases.

Earn even more rewards

If you’re a Bank of America Preferred Rewards member, you can get a 25% to 75% rewards bonus on every purchase.

That means your base 1.5 points per dollar can effectively become up to 2.62 points per dollar, a rate that beats many premium cards, without paying an annual fee.

Learn about protection options

Beyond rewards, the card includes several protections that make it more secure and reliable for everyday and travel use:

- $0 Liability Guarantee: You won’t be held responsible for unauthorized transactions.

- Digital Wallet Technology: Add your card to popular digital wallets for secure, quick, and convenient payments online and in-store.

- Account Alerts: Set up custom alerts to track purchases, payment due dates, and unusual account activity in real time.

- FICO® Score: Get free access to your updated FICO® Score each month to help you monitor your credit health.

- Contactless Chip Technology: Pay faster and more securely with tap-to-pay functionality built into your card.

- Online & Mobile Banking: Manage your account, redeem rewards, and make payments anytime through Bank of America’s online portal or mobile app.

Who is the card suitable for?

Frequent travelers will appreciate that it charges no foreign transaction fees, making it a cost-effective choice for purchases abroad.

Everyday spenders benefit from the simple rewards structure, earning the same flat rate on all purchases without having to track rotating categories.

Existing Bank of America customers, particularly those enrolled in the Preferred Rewards program, can unlock even greater value through boosted earnings.

Budget-conscious users will enjoy the $0 annual fee, which allows them to keep the card at no cost, even if they use it only occasionally.

Finally, the card is also ideal for those seeking an introductory APR offer, as it provides a great opportunity to finance larger purchases interest-free during the first year.

Pros and Cons

Pros:

- No annual fee or foreign transaction fees

- Unlimited 1.5 points per dollar on all purchases

- 25,000-point online bonus offer for new cardholders

- Points never expire

- Boosted rewards for Preferred Rewards members

- 0% intro APR for 15 billing cycles

Cons:

- No travel transfer partners (points can’t be moved to airline or hotel loyalty programs)

- Balance transfer fee applies during intro period

- Requires good to excellent credit for approval

- No premium travel perks like airport lounge access

Find out how to apply for yours

Getting your own Bank of America Travel Rewards Credit Card is simple:

- Visit the Official Application Page: go to the Bank of America website’s Travel Rewards Credit Card section.

- Fill Out the Online Form: provide your personal details, Social Security number, income, and housing information.

- Review Terms and Submit: check the APR, fees, and bonus details before hitting “Submit.”

- Wait for a Decision: many applicants receive an instant decision; some may need additional review.

- Activate and Start Spending: once approved, you can use your card immediately for online purchases through your account or digital wallet.

Did you enjoy learning about the card? To apply and learn more, visit the official website.

Contact Bank of America at 800.932.2775.

Review produced in August/2025. Please note: card details and information may change at any time. Therefore, check the official website before applying.