Bilt Mastercard: Find out the details of the card and whether it is worth applying for

Anúncios

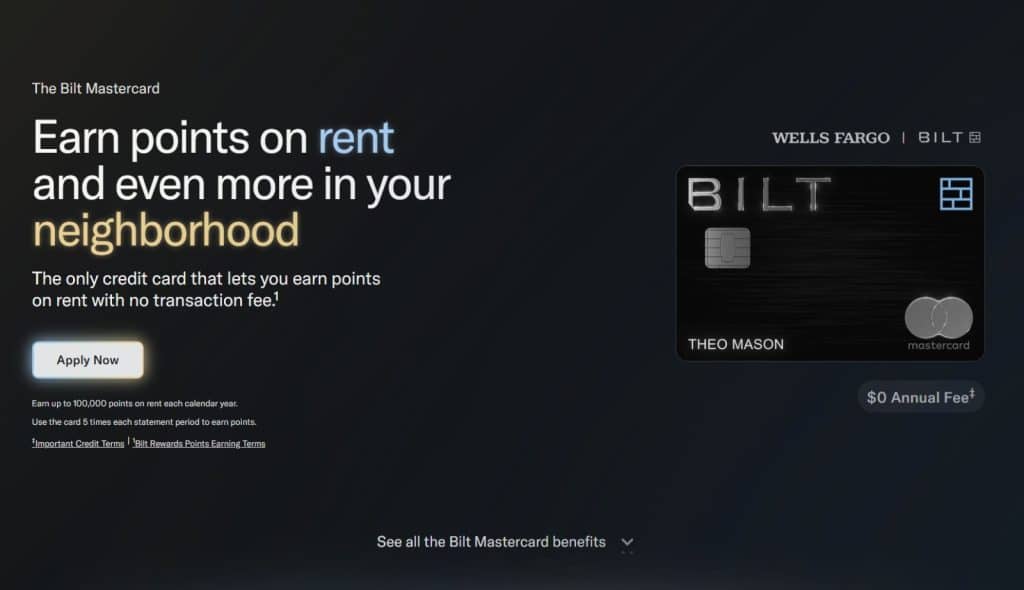

The Bilt Mastercard has quickly become one of the most talked-about credit cards in the market, especially for renters looking to earn rewards on their largest monthly expense, rent.

But beyond just earning points, this card offers a range of benefits tailored to both renters and homeowners, plus enticing travel perks.

Anúncios

In this comprehensive content, we’ll break down the card’s fees, benefits, travel rewards, elite status program, pros and cons, and show you exactly how to apply.

Find out what the card fees are

One of the biggest advantages of the Bilt Mastercard is its no annual fee policy.

Unlike many rewards cards that charge hundreds of dollars per year, the Bilt Mastercard allows you to earn points on rent and everyday purchases without paying an annual fee.

Anúncios

This makes it an affordable choice for those who want to maximize rewards without incurring extra costs.

Key fees to know:

- Annual Fee: $0

- Foreign Transaction Fee: None (great for international travelers)

- Late Payment Fee: Up to $40 (standard industry practice)

- Balance Transfer Fee: Typically 5% (check terms at time of application)

The lack of foreign transaction fees means the Bilt Mastercard is ideal for users who travel abroad and want to avoid extra charges when making purchases internationally.

Learn about the benefits for rentals

With the Bilt Mastercard, you earn 1X points on every dollar of rent paid, allowing you to accumulate rewards without extra cost.

Over time, these points can add up to significant value, turning your rent payments into opportunities to save and gain.

Unlike many other credit cards, the Bilt Mastercard® waives the transaction fee typically charged on rent payments.

What’s more, you can redeem your points toward future rent payments, effectively reducing your out-of-pocket rent costs.

This flexibility helps you manage your budget while enjoying the rewards you’ve earned.

Another outstanding benefit is the ability to redeem points towards a down payment on a home.

For renters dreaming of homeownership, this feature transforms your rent into a valuable stepping stone toward buying a house, making the transition smoother and more achievable.

Additionally, the Bilt Mastercard offers a free service that allows you to boost your credit score by reporting your rent payments to major credit bureaus.

Rent payments often go unreported and don’t help build credit, but with Bilt, your timely payments can positively impact your credit history without extra effort or cost.

Check out the travel benefits

The Bilt Mastercard is not just about rent rewards, it also offers impressive travel perks that make it attractive for frequent travelers:

One of the standout features is the ability to earn 2X points on travel.

Whether you book directly with airlines, hotels, car rental agencies, cruise lines, or through the Bilt Travel Portal, every eligible travel purchase earns double points, helping you accumulate rewards faster.

Trip Cancellation and Interruption Protection safeguards you financially if unexpected issues cause you to cancel or cut short your travel plans.

Additionally, Trip Delay Reimbursement helps cover expenses incurred during travel delays, such as meals and lodging.

For those renting vehicles, the card includes an Auto Rental Collision Damage Waiver, offering coverage against damage or theft on eligible rentals, so you can travel confidently without worrying about extra insurance costs.

Another key travel advantage is that the Bilt Mastercard charges no foreign transaction fees, saving you money on purchases made abroad and making it a smart companion for international trips.

What is Bilt Status Elite?

Bilt Rewards includes a tiered Status Elite program that offers bonus rewards and exclusive perks based on your spending and points earned outside of rent payments.

As you accumulate Bilt Points, exciting opportunities await with the Milestone Rewards program.

For every 25,000 points you earn, you unlock special bonus rewards, including extra Bilt Points for purchases at everyday places like gas stations and grocery stores, adding more value to your spending.

Additionally, achieving Elite Status in the Bilt Rewards program opens the door to exclusive perks such as travel transfer bonuses.

Which allows you to get more points when converting to airline or hotel partners, as well as early access to unique experiences and even status matches with other loyalty programs.

Achieving elite status enhances the value of every dollar spent, making the Bilt Mastercard even more rewarding for dedicated users.

Pros and cons of the card

Pros:

- No annual fee while earning valuable points on rent payments.

- No foreign transaction fees, great for travel.

- Flexible point redemption options including travel, rent, mortgage, and lifestyle products.

- Earn bonus points on dining and travel.

- Tiered elite status program rewards loyal cardholders.

- Ability to pay mortgage with points, a unique feature.

- Recognized as one of the most valuable points programs by Bankrate.com.

Cons:

- Requires 5 monthly transactions to earn full rent rewards; otherwise, you earn only 250 points for rent.

- Limits on earning points on rent capped at 100,000 points per year.

- Credit score requirement is generally good to excellent (around 670+).

- Some features (like travel insurance) are standard but not premium.

- Recently changed card issuer from Wells Fargo to Cardless, with some potential changes in fee structure in the future.

How to Apply for the Bilt Mastercard?

Applying for the Bilt Mastercard is quick and easy:

- Visit the official Bilt Rewards website

- Check eligibility requirements: A good credit score and U.S. residency are typically required.

- Complete the online application form: Provide basic personal and financial information.

- Wait for instant or near-instant approval: If approved, your card is mailed quickly.

- Start using your card to pay rent and everyday purchases to begin earning Bilt Points immediately.

You can also link your rental property or management company to Bilt directly, making rent payments smooth and fee-free.

If you’re a renter or homeowner looking for a credit card that helps turn monthly housing payments into rewarding points with no annual fees, the Bilt Mastercard stands out as a compelling choice.

Ready to learn more or apply? Visit the official Bilt Mastercard page and see if it’s the perfect fit for your wallet.

Contact Bilt at “Chat with Bilt on the website”.

Review produced in August/2025. Please note: card details and information may change at any time. Therefore, check the official website before applying.