Capital One Platinum Credit Card: Benefits and How to get one

Anúncios

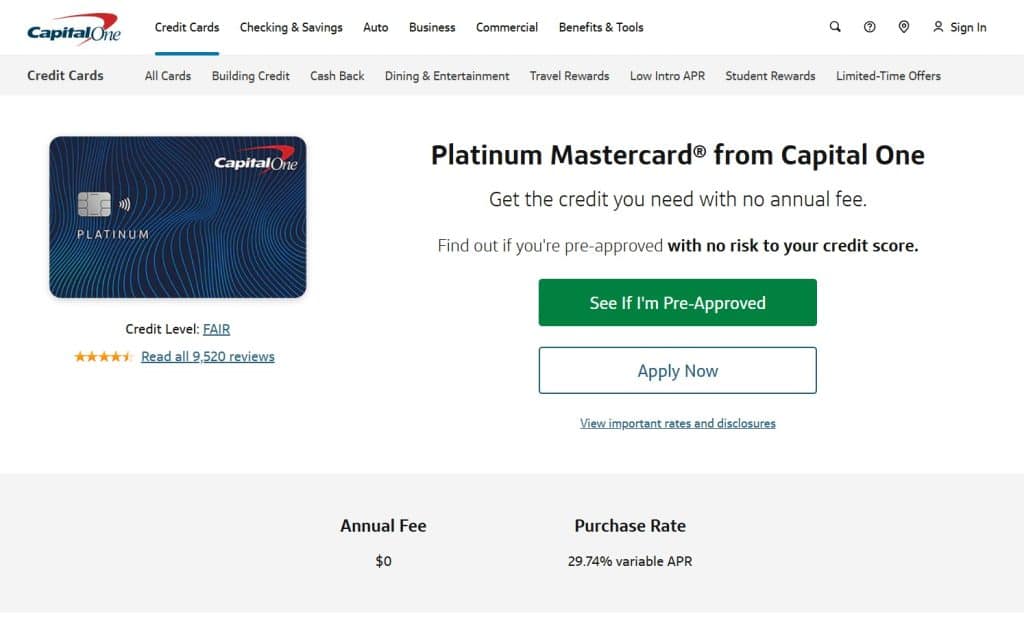

The Capital One Platinum Credit Card is designed for people who want to build or strengthen their credit history while keeping costs low.

With no annual fee and a range of security and account management tools, it’s a solid entry-level card for those with fair credit scores.

Anúncios

Next, we’ll explore its fees, main benefits, pros and cons, and the step-by-step process for getting one, so you can decide if it’s the right fit for your financial journey.

What are the card fees?

One of the most attractive features of the Capital One Platinum is its $0 annual fee, meaning you can keep the card without worrying about yearly maintenance costs.

However, it does come with a high variable APR of around 29.74%, which applies to purchases and balance transfers, making it essential to pay your balance in full each month to avoid interest charges.

Anúncios

Additionally, there are no foreign transaction fees, so you can use it internationally without extra costs.

Late payments may result in fees of up to $40, so timely payments are key to maximizing its benefits.

Learn about the main benefits

Beyond its $0 annual fee and no foreign transaction charges, the Capital One Platinum Credit Card offers a range of features designed to help cardholders build credit, protect their accounts, and make payments more convenient.

These benefits are especially valuable for people focused on responsible credit use and financial growth. Let’s break down the key perks in detail.

CreditWise from Capital One

CreditWise is a free digital tool that comes with your Capital One Platinum account, giving you unlimited access to your TransUnion credit report and your VantageScore 3.0.

It updates weekly and can be accessed through the Capital One mobile app or website.

The platform also includes credit monitoring alerts, notifying you of significant changes such as new accounts opened in your name or sudden drops in your score.

Fraud Coverage

Capital One uses real-time fraud detection systems that analyze your spending patterns and flag suspicious activity instantly.

If an unusual purchase is detected, for example, a large international charge when you typically shop locally, the bank can temporarily block the transaction and contact you for verification.

You can also lock your card instantly from the mobile app if you suspect unauthorized use.

Automatic Credit Line Reviews

One of the most practical benefits for credit-building is Capital One’s automatic credit line review, which typically happens after six months of on-time payments and responsible usage.

A higher credit limit can improve your credit utilization ratio, the percentage of available credit you’re using, which is a major factor in your credit score.

Tap to Pay

With contactless payment technology, your Capital One Platinum allows you to make purchases by simply holding your card near a compatible payment terminal.

It’s faster than inserting a chip and more secure than swiping, thanks to dynamic security codes generated for each transaction.

This reduces the risk of card cloning and makes checkout more convenient, whether you’re buying groceries, grabbing coffee, or paying at a gas station.

Security Alerts

Security alerts keep you informed about what’s happening with your account in real time.

Through push notifications, email, or text messages, Capital One will notify you about large transactions, changes to your account settings, or login attempts from unrecognized devices.

$0 Fraud Liability

Capital One’s $0 Fraud Liability policy means you won’t be held responsible for unauthorized charges if your card is lost, stolen, or compromised.

This protection applies whether the fraud happens in-store, online, or overseas.

It ensures that, even in worst-case scenarios, you won’t face out-of-pocket costs for purchases you didn’t authorize, giving you peace of mind as you use your card daily.

Pros and Cons

Pros:

- $0 annual fee

- No foreign transaction fees

- Automatic credit limit review

- Strong fraud and security features

- Free credit monitoring with CreditWise

Cons:

- High APR (not ideal for carrying balances)

- No rewards or cash back program

- Requires at least fair credit for approval

How to apply for the card?

- Go to the official Capital One website and navigate to the Platinum Credit Card page.

- Use the pre-qualification tool to check your likelihood of approval with a soft credit check (this won’t affect your credit score).

- Review your pre-qualification results to decide if you want to move forward.

- Fill out the online application form, including: Full name and date of birth, Social Security Number (SSN), Annual income and employment details, Monthly housing payment (rent or mortgage).

- Submit your application for processing.

- Wait for the decision, most applicants receive an answer instantly, though some cases may take a few days for additional review.

If approved, your new card will typically arrive by mail within 7–10 business days.

Applying for the Capital One Platinum Credit Card is quick and convenient, especially with the pre-qualification step that helps you avoid unnecessary hard credit inquiries.

Visit the official website for more information and to make your request.

Contact Capital One at 1-877-383-4802.

Review produced in August/2024. Please note: card details and information may change at any time. Therefore, check the official website before applying.