Chase Freedom Unlimited Credit Card: Check out what it offers!

Anúncios

As a reliable and versatile cash-back card with no annual fee, the Chase Freedom Unlimited Credit Card continues to stand out in 2025.

This card combines a solid earning structure with compelling perks, a generous sign-up bonus, and flexible redemption options, all wrapped in a user-friendly package suited for everyday consumers.

Anúncios

Let’s explore how this card can elevate your spending experience.

Benefits of the Card

The Chase Freedom Unlimited Credit Card offers a well-balanced mix of earning potential, ease of use, and cost efficiency, making it one of the most versatile options in the U.S. credit card market.

Each benefit is designed to appeal to a wide range of consumers, from casual spenders to strategic rewards maximizers.

Anúncios

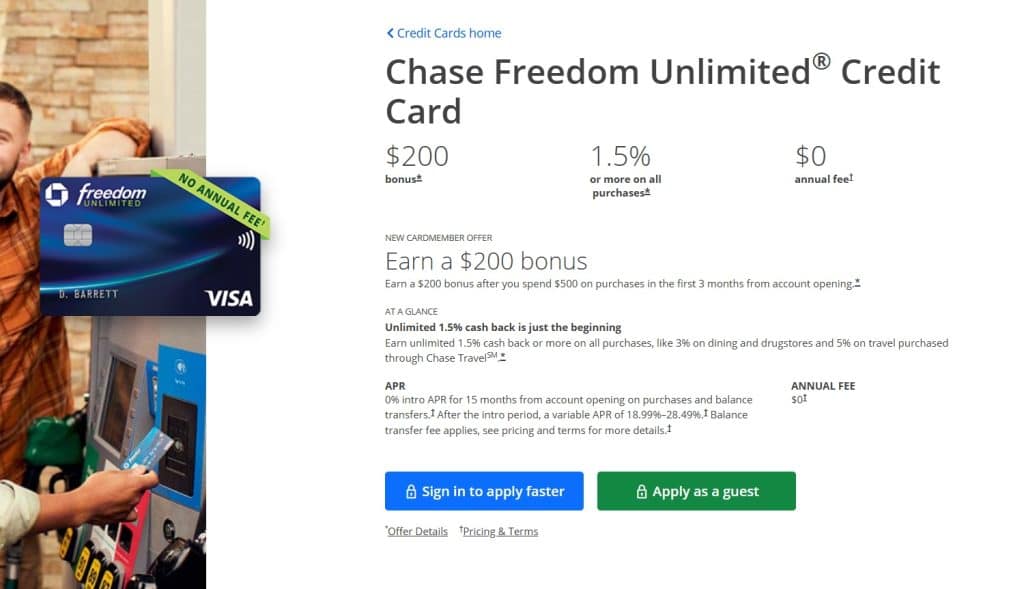

$200 bonus

One of the most attractive features for new cardholders is the welcome offer. When you open a Chase Freedom Unlimited account and spend $500 on purchases in the first three months, you receive a $200 cash bonus.

This threshold is intentionally low, meaning that everyday expenses like groceries, gas, and utility bills could easily qualify you for the bonus.

Unlimited 1.5% cash back

While many cards complicate rewards with rotating categories or spending caps, the Chase Freedom Unlimited Credit Card keeps it simple with unlimited 1.5% cash back on all purchases.

This flat rate applies to everything you buy, so you’re never left wondering whether a purchase qualifies for a higher or lower rate.

The card also offers a competitive rewards structure that makes everyday spending more rewarding.

Cardholders earn 3% cash back on dining at restaurants, including takeout and eligible delivery services, as well as 3% on drugstore purchases.

Travel lovers can take advantage of 5% cash back on trips booked through Chase Travel, while all other purchases earn a solid 1.5% cash back with no limits, ensuring consistent value across every transaction.

Low intro APR

For those planning a major purchase or looking to consolidate debt, the Freedom Unlimited Credit Card offers a 0% introductory APR for 15 months on both purchases and balance transfers.

This allows you to pay off expenses over time without incurring interest during the intro period. After the 15 months, a variable APR applies based on your credit profile.

This feature can be especially valuable if used strategically, for example, buying furniture for a new home or transferring a higher-interest balance from another card to save on interest charges.

Cash Back rewards do not expire

One frustration with some rewards programs is the looming expiration date that forces cardholders to use their rewards before they’re ready.

With the Chase Freedom Unlimited Credit Card, your cash back never expires as long as your account is open and in good standing.

This means you can accumulate rewards over time for a larger redemption goal, such as funding holiday shopping or offsetting a vacation, without feeling rushed.

No annual fee

Perhaps one of the simplest yet most impactful features of the Freedom Unlimited Credit Card is that it comes with no annual fee.

Many credit cards with attractive rewards structures offset them with a yearly charge, but with this card, you keep every cent of your rewards without worrying about breaking even on an annual fee.

This makes it easier to justify keeping the card year after year, which also helps build your credit history over time.

Who is the card suitable for?

The Chase Freedom Unlimited is a strong fit for a wide range of consumers who value both simplicity and flexibility in a rewards credit card.

It’s ideal for individuals who prefer to carry a single, no-hassle card that earns a consistent return on every purchase, without the need to track spending categories or chase limited-time offers.

This card is also well-suited for anyone seeking a competitive introductory APR period, whether to finance a large purchase or to consolidate higher-interest debt, thanks to its 0% intro APR on purchases and balance transfers for the first 15 months.

However, it’s not the perfect match for everyone. Those who travel internationally often may find the card less appealing because of its 3% foreign transaction fee, which can add up quickly when making purchases abroad.

Pros and cons

Pros:

- High baseline return on all purchases, 1.5% unlimited cash back.

- Targeted bonus categories that boost rewards for travel, dining, and drugstore purchases.

- Low introductory spending requirement to secure the $200 bonus.

- Extended 0% APR period, offering financial flexibility.

- No annual fee and rewards that don’t expire.

Cons:

- 3% foreign transaction fee, making it less fitting for international use.

- Post-intro APR can be high, up to 28.49%, if balances aren’t paid in full.

- Rewards still worth just 1 cent each unless elevated by a Sapphire card or redeemed strategically.

How to Apply for the Chase Freedom Unlimited?

Applying for the card is straightforward and can typically be completed online through Chase’s official site.

- Confirm basic eligibility;

- Review the current offer and key terms;

- Decide whether to prequalify;

- Gather your information: Legal name, date of birth, SSN/ITIN, phone and email, residential address. Employment status, annual income, and monthly housing payment (rent/mortgage);

- Complete the application accurately.

Did you enjoy learning more about the card? For more details and to apply, visit the official website.

Contact Chase at 1-800-432-3117.

Review produced in August/2025. Please note: card details and information may change at any time. Therefore, check the official website before applying.