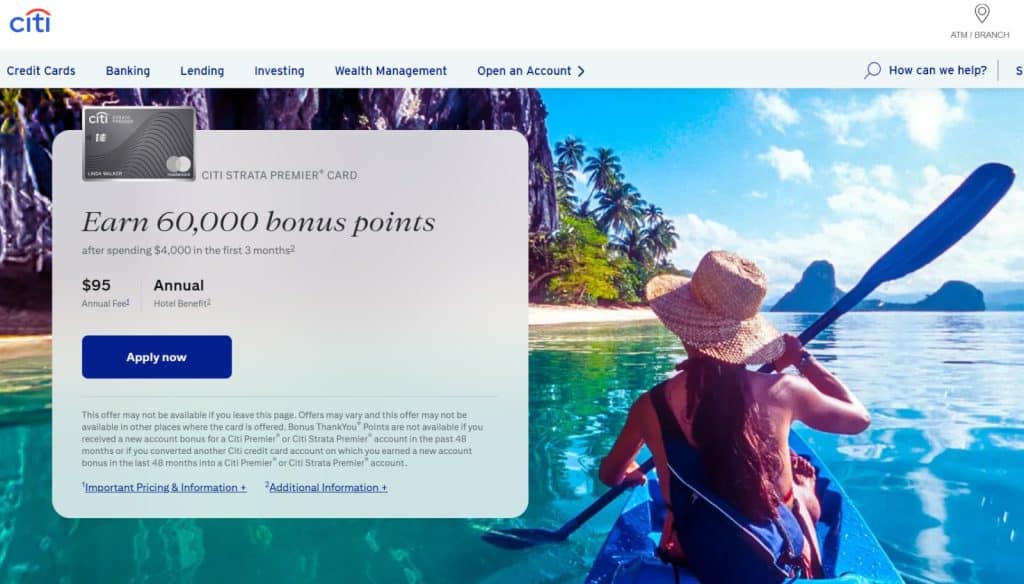

Citi Strata Premier Credit Card: All the details and How to apply

Anúncios

The Citi Strata Premier Credit Card is a credit card designed for those who want to make the most of their everyday spending while enjoying incredible travel rewards, purchase protections, and other perks.

From earning points on dining and travel to offering protection against identity theft, this card has a lot to offer.

Anúncios

Let’s dive into the details of the Citi Strata Premier Credit Card to help you understand whether it’s the right choice for you.

Get to Know the card fees

Before you apply for the Citi Strata Premier Credit Card, it’s important to understand the costs involved. Here’s a quick breakdown:

- Annual Fee: $95

- Foreign Transaction Fee: None, perfect for international travelers!

- Cash Advance Fee: Either $10 or 5% of the cash advance amount, whichever is greater.

While the annual fee is on the higher side for some, the benefits often outweigh this cost, especially if you’re a frequent traveler or spend a lot in bonus categories like dining and travel.

Anúncios

Understand the Card Benefits

The Citi Strata Premier Credit Card offers several benefits, each designed to provide value for your everyday spending and travel needs. Let’s break down these perks:

Citi Travel

With the Citi Strata Premier Card, you can earn 10 points per dollar spent on travel booked through CitiTravel.com. This includes flights, hotels, car rentals, and attractions.

If you travel often, this is one of the best ways to rack up points quickly, which can then be redeemed for a wide range of travel rewards.

Gift cards, cash back and more

The points you earn can be redeemed in multiple ways, including gift cards, cash back, or as a statement credit.

1 point typically equals 1 cent when redeemed through the Citi ThankYou® Rewards program. This offers you the flexibility to use your rewards however you prefer.

Shop with points

If you prefer to shop online, you can use your points to make purchases at retailers that partner with Citi.

Simply redeem your points at checkout, and you can pay for your items using your earned points.

Digital wallets

The Citi Strata Premier Card is compatible with Apple Pay, Google Pay, and Samsung Pay, making it easy to store your card on your phone and pay with a tap at millions of merchants worldwide.

Mastercard ID Theft Protection

Your security is a priority with the Citi Strata Premier Card. It includes Mastercard ID Theft Protection, which monitors your identity and alerts you if there’s suspicious activity.

In case your identity is compromised, Citi provides resources to help resolve the issue.

Pros and Cons

Like any credit card, the Citi Strata Premier® Card has its advantages and drawbacks. Here’s a quick summary:

Pros:

- High reward earning potential in travel, dining, and everyday categories.

- No foreign transaction fees, perfect for international travelers.

- Flexible redemption options including travel, gift cards, and cash back.

- Robust travel protections including trip cancellation insurance and rental car coverage.

- Mastercard ID Theft Protection for enhanced security.

Cons:

- Annual fee of $95, which may not be justified if you don’t spend heavily in reward categories.

- High APR for those who carry a balance.

- Limited 5x earning potential compared to some other travel cards.

Learn More About Citi

Citi (Citigroup Inc.) is one of the largest and most reputable financial institutions in the world, with a history spanning over 200 years.

Founded in 1812 in New York, the company has grown globally and now offers a wide range of financial services, including retail banking, credit cards, corporate banking, investment services, insurance, and asset management.

With a presence in over 100 countries, Citi serves millions of customers worldwide, from individuals to large corporations and governments, providing innovative financial solutions tailored to the needs of its clients.

Additionally, Citi is widely recognized for its commitment to corporate social responsibility, focusing on investing in projects that promote sustainability, financial inclusion, and global economic development.

Through its digital platform, like the Citi Mobile® App, the bank makes it easy for customers to access banking services, make payments, and manage accounts in a convenient and secure manner, reinforcing its role as a leader in financial innovation.

How to Apply for the Citi Strata Premier?

Applying for the Citi Strata Premier Credit Card is a simple process. Follow these easy steps to get started:

- Visit the Citi Website: Go to the official Citi website to start your application process. Look for the Citi Strata Premier Card page to ensure you’re applying for the correct card.

- Click on “Apply Now”: Once on the Citi Strata Premier Card page, click the “Apply Now” button to begin the application.

- Enter Personal Information: Provide your personal details.

- Provide Financial Information: You’ll be asked to submit your financial details.

- Review Your Credit History: Citi will check your credit history to determine your eligibility for the card.

- Agree to Terms and Conditions: Read through the terms and conditions of the card and check the box agreeing to them.

- Submit Your Application: Double-check all the information you’ve entered. Once you’re satisfied, click the “Submit” button to send your application.

- Wait for Approval: After submission, Citi will process your application. If you’re approved, you’ll receive your Citi Strata Premier Credit Card in the mail within a few business days.

The Citi Strata Premier Credit Card is a great option for those looking to earn valuable rewards on everyday spending, with excellent benefits for travel and security.

Want more information about the card and to apply for yours? Visit the official website.

Contact Citi at 1-800-347-4934.

Review produced in August/2025. Please note: card details and information may change at any time. Therefore, check the official website before applying.