Wells Fargo Active Cash Card: A Path to Unlimited Rewards

Anúncios

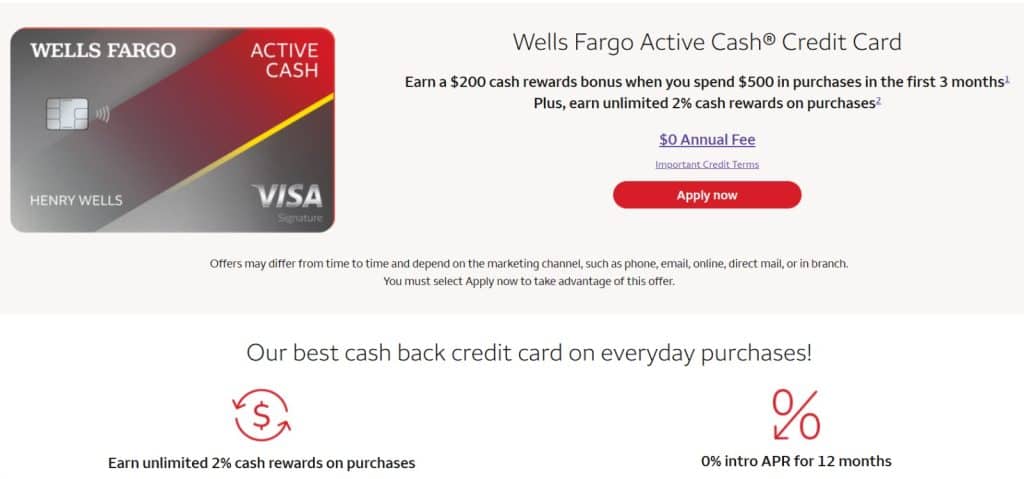

The Wells Fargo Active Cash Card offers one of the most straightforward and rewarding cashback structures in the U.S. credit card market.

Designed for simplicity, it allows cardholders to earn a flat, unlimited 2% cash rewards rate on every purchase, whether you’re buying groceries, paying utility bills, shopping online, or booking a flight.

Anúncios

Let’s break down exactly what makes it stand out.

Discover the card benefits

Wells Fargo has positioned the Active Cash Card as a versatile option that blends everyday usability with valuable perks.

Beyond its core cashback feature, the card offers robust protections, exclusive deals, and premium travel benefits through the Visa Signature® network.

Anúncios

Cashback

The primary reason most people choose the Active Cash Card is its unlimited 2% cashback on all purchases.

Unlike cards that offer higher rates in specific categories but just 1% on everything else, the Active Cash keeps things simple:

- No rotating categories to activate.

- No earning caps, you can earn as much as you spend.

- Consistent value whether you’re buying a coffee, filling up your gas tank, or booking a vacation.

This makes it a great everyday card for people who don’t want to juggle multiple credit cards to maximize rewards.

Cash rewards bonus

New cardholders of the Wells Fargo Active Cash Card can kickstart their rewards with a generous $200 cash rewards bonus after spending $500 in purchases within the first three months of account opening.

This welcome offer is designed to be attainable for everyday spenders, as the threshold can be met with regular expenses like groceries, gas, or utility bills.

Once earned, the bonus, along with all other cashback from your purchases, is automatically deposited into your Wells Fargo Rewards account.

Zero Liability Protection

Security is a major factor when choosing a credit card. The Active Cash Card is covered by Visa’s Zero Liability Protection, meaning you won’t be held responsible for unauthorized transactions if your card is lost, stolen, or used fraudulently.

The car also offers valuable protection and assistance benefits. Cardholders receive up to $600 in cell phone protection against damage or theft when their monthly bill is paid with the card, subject to a $25 deductible.

While traveling, you can rely on Travel and Emergency Assistance Services, available worldwide to help with emergencies

My Wells Fargo Deals

Available through your Wells Fargo online banking or mobile app, this feature provides a rotating selection of personalized offers from a wide variety of merchants.

Including popular retailers, restaurants, entertainment venues, and service providers.

To take advantage of a deal, you simply activate the offer before making a purchase with your eligible Wells Fargo credit card.

It’s a simple, hassle-free way to boost your earnings while shopping, dining, or enjoying experiences you already planned, making your everyday spending even more rewarding.

Exceptional Visa Signature privileges

As a Visa Signature® card, the Active Cash comes with benefits typically reserved for premium travel cards, including:

- Luxury Hotel Collection Access: Perks like complimentary breakfast, room upgrades when available, late checkout, and special welcome amenities at over 900 properties worldwide.

- 24/7 Concierge Service: Assistance with travel planning, dining reservations, event tickets, and gift arrangements.

These benefits add significant value for travelers, even though the card is not primarily marketed as a travel rewards product.

Who is the card suitable for?

The Wells Fargo Active Cash Card is well-suited for everyday spenders who prefer using a single card for all their purchases without the hassle of tracking rotating categories.

It’s an excellent choice for those who value straightforward cash rewards over points or miles.

And it offers added convenience for Wells Fargo banking customers who can seamlessly redeem their rewards into existing accounts.

Cardholders also benefit from premium perks without paying an annual fee. However, it may be less appealing for frequent international travelers because of its 3% foreign transaction fee.

And it’s not the best match for travel rewards enthusiasts who focus on maximizing points for luxury travel experiences.

Pros & Cons

Pros:

- Unlimited 2% cashback on all purchases.

- $200 welcome bonus after $500 spend in the first 3 months.

- 0% intro APR for 12 months on purchases and balance transfers (made within 120 days).

- No annual fee.

- Cell phone protection up to $600 (with $25 deductible).

- Access to Visa Signature® travel and lifestyle perks.

- Easy redemption options, especially for Wells Fargo customers.

Cons:

- 3% foreign transaction fee makes it less travel-friendly abroad.

- Rewards are most convenient to redeem if you bank with Wells Fargo.

- No elevated categories for higher earn rates, flat rate may be less rewarding for big spenders in specific categories.

How to apply for the Wells Fargo Active Cash Card?

Applying for the Active Cash Card is simple and can be done in a few steps:

- Check your credit score

- Gather your information: Social Security number, income, employment details, and housing costs.

- Apply online via Wells Fargo’s official website, by phone, or in person at a branch.

- Wait for approval: Some applicants may receive instant approval, while others may need to provide additional documentation.

- Activate your card upon arrival, then set up online banking to track rewards and manage your account.

If you’re already a Wells Fargo customer, applying through your online banking account may streamline the process.

For more information and to apply for the card, visit the official website:

Contact Wells Fargo at 1-800-869-3557.

Review produced in August/2025. Please note: card details and information may change at any time. Therefore, check the official website before applying.